In Commercial Banking, Relationships Remain Top Priority but the Dynamics are Shifting

Relationships have always been critical to the banking industry, even as technological innovation has made it possible to bank anytime, anywhere and often without interacting with another human. This is especially true in consumer finance, where institutions vie for clients on the strength of their automated banking capabilities.

On the commercial banking side, where greater transactional complexity and volume typically demand higher-touch service, rapid technological change is reshaping the relationship between commercial bankers and their clients. Now more than ever, business clients have a greater choice in how they engage with their commercial banking partner. As a result, those partners must be nimbler and more tech-savvy than ever before to ensure that they are providing their clients with the best quality service to help grow their businesses.

Backdrop

The digital transformation of the bank-client relationship was already well underway before the global pandemic accelerated the need for business clients to interact with their bank teams in new ways. Common processes from business deposits to payments and foreign exchange are now routinely automated, as commercial banks emphasize client experience and technology for business clients, recognizing their unique needs around digital convenience and accessibility.

Relationship Basics

At Synovus we have seen a shift toward digital channels among our commercial clients, who increasingly demand greater personalization and flexibility in how they bank. This has made us more adaptable, as we meet our clients where they are. Regardless of technological proficiency, business owners require a unique level of in-person guidance and personalized advice from their bankers. This means that in addition to providing cutting-edge technologies, we as an industry must continue to emphasize the human touch—cultivating long-term relationships and meeting our clients in person to learn about their business, challenges, and growth priorities.

We believe there are a few key elements of the bank-client relationship:

- Trust & Transparency – Building trust and fostering transparency are crucial elements of banking relationships at Synovus, ensuring clients feel confident in their financial decisions.

- Financial Expertise – Clients benefit from the financial expertise and guidance provided by Synovus professionals, helping them make informed decisions that align with their goals.

- Community Engagement – Being deeply rooted in the community, Synovus emphasizes community engagement and support, reflecting a commitment to local prosperity.

- Speed to market and credit decisions – Synovus prioritizes speed to market, demonstrating agility and responsiveness in delivering banking solutions to meet client needs promptly.

- Local decision making – At Synovus, local decision making plays a pivotal role in banking relationships. Decisions are made locally by professionals who understand the unique needs and dynamics of the community.

Technological advancement has not changed any of these core concepts but instead has caused them to evolve. Trust, for example, now includes digital security and data privacy. Customer service has become more personalized, available anytime or anywhere. Knowledge requires deeper industry insights and business acumen. And local decision making has become more empowered and agile.

The Georgia Connection

An influx of people and businesses to Georgia has fueled demand for commercial banks that can provide the best of both worlds—technology and service. Our state’s vast entrepreneurial community, led by growth in industries from technology to ports to film production means that commercial bankers need to be experienced in all aspects of the business from start to finish.

We’re proud to be among leaders in fostering vibrant and diverse business communities. Atlanta has long been an exemplar of African American entrepreneurship and regularly receives top marks as a business hub for entrepreneurs of color. It is also an ideal location for LGBTQ individuals and women to pursue their entrepreneurial goals. Atlanta’s ranking as a top place to live and raise a family has driven demand for financial services tailored to the needs of diverse communities. At Synovus, we are honored to cater to the unique needs of Georgia’s comprehensive business community.

We’re proud to be among leaders in fostering vibrant and diverse business communities. Atlanta has long been an exemplar of African American entrepreneurship and regularly receives top marks as a business hub for entrepreneurs of color. It is also an ideal location for LGBTQ individuals and women to pursue their entrepreneurial goals. Atlanta’s ranking as a top place to live and raise a family has driven demand for financial services tailored to the needs of diverse communities. At Synovus, we are honored to cater to the unique needs of Georgia’s comprehensive business community.

We believe that the ongoing digital transformation of the bank-client relationship is here to stay, and that innovation will reshape—not replace—the critical human relationships that have always been the center of our industry.

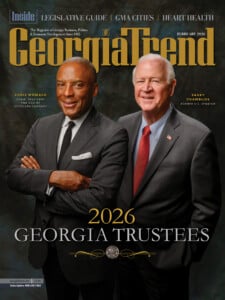

Cory Jackson is Market Executive of Synovus Bank in Atlanta.