Say Yes to Tax Relief

Our economic growth may provide an answer for tax relief on families.

With affordability ranking as voters’ top concern, elected officials are looking for ways to bring relief, but there are no easy answers for the rising costs of groceries, energy, childcare, homes and health insurance.

On the local level, concerns have focused on rising property taxes. The increase in home values has brought ever bigger evaluations that have sent homeowners’ tax bills soaring. County governments, like the citizens they serve, are facing inflationary pressures on operational costs.

On the local level, concerns have focused on rising property taxes. The increase in home values has brought ever bigger evaluations that have sent homeowners’ tax bills soaring. County governments, like the citizens they serve, are facing inflationary pressures on operational costs.

There are reasonable solutions, if counties are willing to seize the opportunities that present themselves. Our economic growth may provide an answer for tax relief on families, but the biggest hurdle to those solutions are very people who would benefit from lower taxes.

Many counties – even some with declining populations and little hope of economic development wins – have a new opportunity to fill county coffers with private investments that will flood county treasuries without adding any new expenses for law enforcement or school districts.

Data centers are popping up all over the state to meet the demand created by our online world and the computing power needed to fuel AI. These data centers consume energy at a furious pace. And rising demand requires rising supply. This will include new natural gas plants but also means adding solar fields and battery capacity.

New data centers and solar fields are meeting stout opposition across the state, however. Critics worry that data centers will drive up energy costs for regular consumers, slurp up the local water supply, create noise and potentially lower nearby property values. Those trying to stop solar fields don’t like that they often use fertile farmland, detract from the natural beauty of rural landscapes and cause erosion that might run off onto neighboring properties.

Some of those concerns are valid, but counties should approach those opportunities by seeking to mitigate those problems rather than just saying no. Finding a way to yes will attract the loud voices of opposition from the few but deliver potential tax relief to the many. Property owners squeezed by rising valuations or millage rates should insist on it.

The Meta data center in Stanton Springs will pay $5 million annually by 2033, divided among Walton, Morgan, Jasper and Newton counties. The impact goes further as Meta/Facebook gave $370,000 to Social Circle City Schools to buy Chromebooks for all students in grades 3-12 and funded STEM initiatives and robotics and coding programs in other local schools.

A potential “hyperscale” data center under consideration in Coweta County on 800 acres next to Georgia Power’s Plant Yates could bring in an utterly jaw-dropping $160 million-plus a year in new revenue. Once complete, that stretch of land would have as much tax value as the rest of the county combined. Because it neighbors a power plant, it wouldn’t need giant metal transmission lines through neighborhoods that have sparked opposition to data centers elsewhere.

Despite the cash cow it would bring Coweta, that project has faced immense opposition locally and its future is uncertain. One way to address fears that the data center will change the rural landscape is to use some of the new money for the county to purchase and preserve the surrounding undeveloped land – land in a growing exurban county that would eventually get gobbled up by developers.

Solar companies are looking to build projects in rural counties in Middle and South Georgia where local populations and economies have seen long decline. For a project to get selected by a power company it must submit a competitive bid on pricing, which depends on land prices and tax rates.

I witnessed a solar company’s negotiations with two Middle Georgia counties over the past year go nowhere, even though county and school tax income from those plots of land would rise from approximately $30,000 a year to more than $600,000 a year for the life of the project.

Georgia voters overwhelmingly approved a constitutional amendment that would limit the increase in property taxes to the rate of inflation – showing this is an issue voters want addressed. But one-third of local governments took advantage of a loophole that allowed them to opt out – showing they foresee future revenue crunches.

That money doesn’t have to come from taxpayers – and taxpayers who are tired of ever higher bills should counter the protests of those trying to stop the economic development that could bring relief.

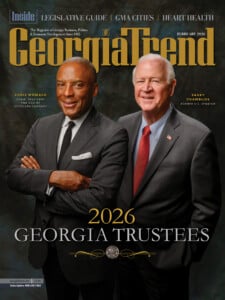

Brian Robinson is co-host of WABE’s Political Breakfast podcast. He won a Green Eyeshade award in 2024.