Georgia’s Fintech Evolution

The state’s historic relationship with banks links the industry’s past and future.

There’s a well-known saying that when one door closes, another one opens. Perhaps no American city is better than Atlanta at opening doors to new opportunities.

The city has a long history of doing just that. The most chronicled story of that history, of course, is Atlanta’s rise from the ashes of the Civil War. A lesser-known story, but one with drama of its own, is how modern-day Atlanta turned a business defeat – losing the title of Banking Capital of the South to Charlotte, North Carolina, in the 1980s – into an opportunity, creating a new industry.

In the early 2000s, a heady time after the 1996 Olympics, there was a lot of talk about how Atlanta could become an innovator. Some suggested telecommunications. Others favored security. Then-Gov. Sonny Perdue supported biotech. As it turned out, though, the door to the kind of innovation that city and state leaders sought was right in front of them. When they opened it, what they discovered would give Atlanta and Georgia a new global brand – fintech, or financial technology.

Two decades later, fintech – a huge and growing industry that helps businesses of all sizes receive payments from financial transactions efficiently and seamlessly – has become one of Georgia’s greatest digital-age successes, says Gardiner Garrard, cofounder and managing partner of venture capital firm TTV Capital in Atlanta. Garrard would know. He entered the venture capital arena in the late 1990s and was named one of the 40 fintech power players in the country by Institutional Investor in 2018, in part because he had the foresight to see the impact technology would have on the delivery of financial services.

Today, there are more than 260 fintech companies in Georgia, the ecosystem employs an estimated 42,500, and the top 12 Georgia-headquartered public fintech companies collectively generate revenues of approximately $49 billion, according to the Technology Association of Georgia (TAG). Additionally, in 2021, Georgia fintech companies processed two-thirds of the U.S. transactions, also according to TAG.

How did Georgia, and more specifically Atlanta, get to this point? The answer is that banks, technical companies and rapidly changing technology evolved through a variety of homegrown companies, startups, spinoffs, entries from other locations, and mergers and acquisitions into an ecosystem linked to both Georgia’s past and future – with a profound impact on the state’s economy and the way its residents, merchants and corporations conduct their finances.

From Banking to Technology

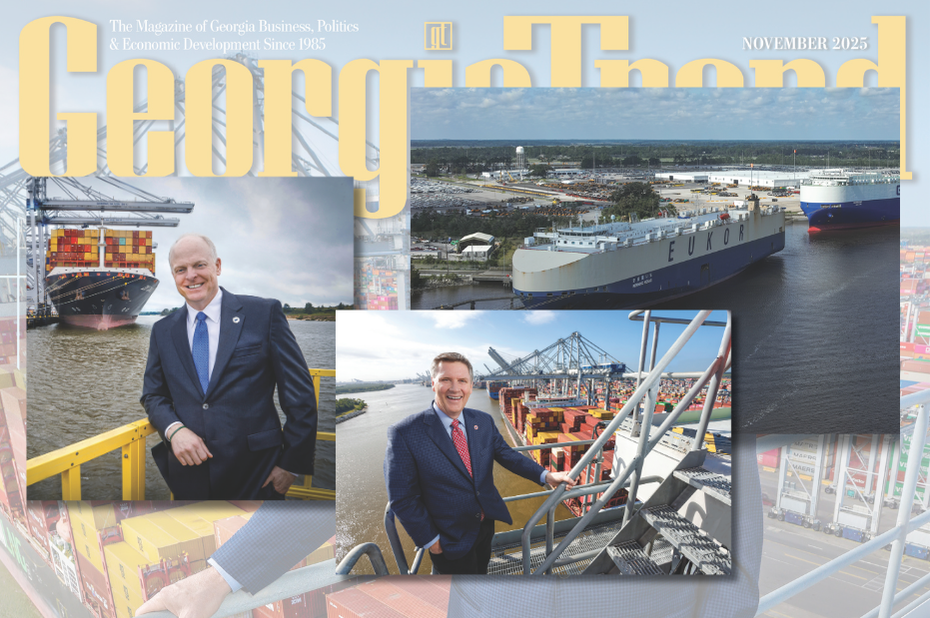

Superior Knowledge: Larry Williams, president and CEO of the Technology Association of Georgia. Photo credit: Kevin Garrett

The story of that evolution begins in the 1980s with changes in federal regulations. It was a time when banks began buying banks from other states. Several banks headquartered in North Carolina looked south and began buying Georgia banks. As a result, the banking capital of the South shifted to Charlotte.

Yet in those brick-and-mortar days of finance, Georgia was also a hub for check processing performed by third-party vendors. “We had a superior knowledge of [that] process and could envision what it could look like in a digital world,” says Larry Williams, president and CEO of TAG, which celebrated its 25th anniversary last year. It was that vision that evolved into a new payments-processing ecosystem of banks, technology companies, apps, merchants and consumers.

“We didn’t just adopt [the ecosystem] or decide we were going to do processing here,” says Williams. “We helped create the systems that digitized the whole process that has become known as fintech.”

“While core banking operations moved out of Georgia, many people running those operations remained. That human capital became the foundation for the next generation of companies that sold technology services back to the banks,” says Garrard. “That included credit card processing, merchant processing, check processing, bill pay, online banking, even Equifax, which was serving the financial services ecosystem with credit risk, scores and credit data. Essentially, we shifted from being a hub of banking to a hub of technology services being sold back to the bank.”

“We didn’t just adopt [the ecosystem] or decide we were going to do processing here. We helped create the systems that digitized the whole process that has become known as fintech.” Larry Williams, president and CEO, Technology Association of Georgia

The technology services that Garrard references included some fintech or payment processing companies already in Metro Atlanta in the 2000s, including CheckFree, First Data Corp. and Global Payments (formerly part of National Data Corp.). Elavon (formerly NOVA Corp.), Fiserv and Corpay (formerly FLEETCOR) were also part of the early Atlanta fintech scene between 2000 and 2010.

Columbus Bank and Trust (now Synovus), which had been offering third-party credit card processing in Columbus since the ‘70s, established Total Systems Services, known as TSYS, as a transaction processor in 1983 and spun it out as a separate company in 2007. TSYS developed a new processing technology that became the industry standard and played a key role in Georgia’s rise as a technology hub. The ecosystem provided a solid foundation for companies such as Corpay, once a one-dimensional fuel card provider, to grow into a global payments company that processes more than $235 billion annually in 200-plus countries.

“The early 2000s was a transition period between the dot-com boom and the birth of fintech where, despite new technology, many companies were still paying bills using paper checks and hand-written ledgers,” says Crystal Williams, Corpay chief human resources officer. “Our CEO, Ron Clarke, saw an opportunity to replace these antiquated payment processes with digital solutions that would pay bills faster and with less risk.” The foundation solidified when the buzz from those early years caught the attention of entrepreneurs, who launched startup ventures in and around Atlanta.

As those ventures increased in number, companies located elsewhere took notice and moved headquarters or operations to Metro Atlanta. Along the way, high-profile acquisitions and mergers further shaped the fintech landscape, with some prominent brand names disappearing altogether. In 2001, for example, U.S. Bancorp acquired NOVA for $2.1 billion in stock and cash, and in 2007 Fiserv acquired CheckFree for $4.4 billion.

Australian-born Dave Excell is a poster child for global entrepreneurs who brought groundbreaking technology to Atlanta to gain proximity to major payment processors. In 2008 while attending Cambridge, he founded Featurespace, a company dedicated to applying AI to combat fraud. Later, Excell and Featurespace forged a strategic alliance with TSYS, leading to the development of a real-time fraud detection solution, Foresight Score. Last September, Visa’s Value-Added Service business unit announced it would acquire Featurespace for an undisclosed amount. “The city’s supportive environment enabled us to build strong partnerships and deliver cutting-edge solutions that make the world a safer place to transact,” says Excell.

Georgia’s fintech landscape underwent an earthquake of changes during a few short months in 2019 when six of the world’s largest Fintech firms consolidated into three: Global Payments merged with TSYS in a $21.5 billion deal, Fiserv purchased First Data for $22 billion in an all-stock deal, and FIS and Worldpay merged in a deal valued at $43 billion. The landscape changed again in 2023 when private equity firm GTCR acquired a 55% ownership in Worldpay, and last year when Global Payments announced it is aligning its branding under a common umbrella. The Global Payments move will eliminate the name TSYS, reducing one of Georgia’s most-recognized home-grown fintech brands to a historical footnote.

Capitalizing on Crisis

The 2007-2008 financial crisis changed the direction of the industry, says Garrard. That’s when many venture capitalists became aware that banks weren’t developing their own software and saw the need for financial services. And many fintech companies realized they could create products and services and sell them directly to consumers.

The financial crisis also fractured the trust between banks and their customers, which led to fintech companies developing innovative direct-to-consumer products. Entrepreneurs saw an opportunity to boost bank-customer trust through product innovation by doing traditional bank products better than the bank. Atlanta-based Greenlight is an example. It is a privately held startup company that has reached unicorn status with a valuation of more than $2 billion – and in which TTV Capital is an investor – that offers debit cards to children with parental supervision. Innovative products like this, Garrard says, allowed fintech companies to get some of the functionality of banks, without needing a bank charter.

Teaching About Finance: Greenlight offers debit cards to children age 8 or older with parental supervision. Photo credit: Contributed

Working independently of banks, however, brought fintech innovators to a reckoning with reality, according to TTV Capital. They realized they can’t do some things that banks do as well as the banks. They found out customer acquisition is expensive, and banks already have the customers – millions of them – and the distribution networks.

Greenlight Cofounder and President Johnson Cook acknowledges that TTV invested in Greenlight not only because it solved a common-sense family problem of converting cash to online banking and digital payments but also because it had the potential to create customer acquisition opportunities for banks. Perhaps that explains why major banks, as well as regional and community banks and credit unions, are adopting Greenlight.

“Although we have over 100 financial institutions and brands as partners and over 6 million consumers on our products, we believe the family finance tech category is still in the early days and wide open with tremendous opportunity ahead,” says Cook.

Fintech is poised to take advantage of that growth because it is the backbone of commerce in the U.S. and world, adds TAG’s Williams. Fintech growth forecasts by Boston Consulting Group and QED Investors indicate that backbone will need to be strong. Fintech revenues will grow sixfold globally from $245 billion to $1.5 trillion and fourfold in the U.S. to $520 billion by 2030, constituting almost 25% of all banking valuations worldwide, according to Global Fintech 2023: Reimagining the Future of Finance.

Growth Mindset: Glen Whitley, director for the Center of Innovation for Information Technology at the Georgia Department of Economic Development. Photo credit: Kevin Garrett

Georgia’s fintech ecosystem will be leading the way to capitalize on that growth, says Glen Whitley, director of the Center of Innovation for Information Technology at the Georgia Department of Economic Development. “We’re as good as anybody in the world.”

Georgia’s financial technology firms provide a competitive advantage in fulfilling Whitley’s faith in the state’s fintech ecosystem. “It makes for a really rich hub for human capital, core competencies [and] technology integrations behind the firewall networks of the banks,” says Garrard. As a result, entrepreneurs from all over the world come to Atlanta with their innovations because it’s a hub for payments processing. Even companies that don’t move to Georgia, Garrard adds, distribute their technology through platforms here.

Just as Atlanta’s fintech ecosystem attracts entrepreneurs, it also is a magnet for support groups. The Washington, D.C.-based Independent Community Bankers of America (ICBA), for example, works with state affiliates such as the Community Bankers Association of Georgia to connect small business fintech companies with community banks, says Charles Potts, executive vice president and chief innovation officer at ICBA.

The cornerstone of ICBA’s innovation program is the ICBA ThinkTECH accelerator, a 10-week bootcamp that connects entrepreneurs with bankers and subject matter experts in accounting, regulatory, legal, venture capital and other fields. “It’s important that a banker or tech in Elberton or St. Marys or Albany or Ringgold knows that there is a place in Atlanta where they can come to find out how fintech technology can help their bank be better at serving customers and communities. And there’s a place in Atlanta where any fintech entrepreneur … around the state may be thinking about how to address the needs of community banks,” says Potts.

If it seems like just yesterday that Atlanta and state leaders kicked off the ecosystem growth that has spurred Georgia’s fintech evolution, in a sense it was. A chronological clock registering the speed of technological change would show the evolution took place in a nanosecond of time. After all, fintech didn’t even have a name when Atlanta opened the door to the then-new technology. Or, as Garrard points out, “we didn’t call it that in 2000.”

As far as fintech has come in Georgia in just two decades, there’s even more room for it to grow in the future. “There are still trillions of dollars in payments being made every year with checks and ACH,” says Corpay’s Williams. “We’ve only scratched the surface on what’s to come.”